Outrage as UCAS emails students about high-interest loan company

SECOND UPDATE (07/02/20): UCAS have 'decided to pause' promotion of Future Finance.

UPDATE (22/01/20): UCAS has since sent out another email promoting Future Finance.

As a fundamental part of the uni application process, UCAS should be unwaveringly trustworthy – but last week, for some, they abused their position with a controversial email.

Credit: GaudiLab – Shutterstock

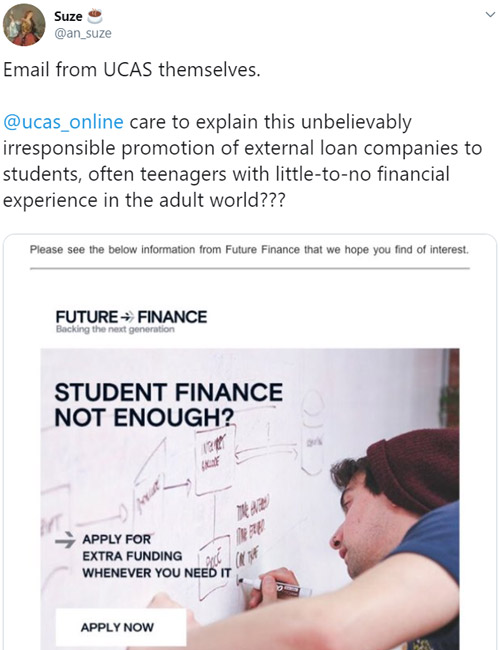

On 22nd August, UCAS Media sent out a marketing email to students, asking in the subject line, "is your Student Finance going to be enough?".

It's no secret that, all too often, the Maintenance Loan isn't enough to cover student living costs. But at Save the Student, we work hard to make sure students know about their many options for making and saving money.

Commercial loans with high interest rates should only ever be used as a last resort. So, why did UCAS – an organisation which helps people as young as 16 – send a marketing email about a private-loan company to students without highlighting other lower-risk alternatives alongside it?

Understandably, many have expressed their outrage on Twitter, including the NUS, academics, students and Save the Student.

Who are Future Finance?

Future Finance are a for-profit company which provides private loans between £2,000 – £40,000 to students in the UK – but this funding can come with pretty sizable interest rates.

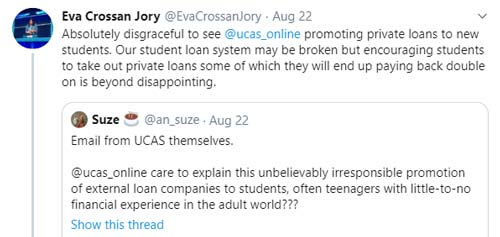

They tailor their loans to students based on graduate earning potential. But, on their site, they give the example of loans with an interest of 15.9% APR, which is over double the max interest on government Student Loans.

While at uni, you'd repay the loan at a reduced monthly cost but, once you've graduated, Future Finance give you up to three months before the loan repayments increase significantly.

Expectations of guarantors for Future Finance loans

For grads who are unable to repay the loan, their guarantors would need to help cover it. Future Finance say on their website that guarantors are usually a parent, sibling or close friend. They present it as an act of generosity, suggesting, "becoming a guarantor may be one of the greatest gifts [the student will] ever receive".

There are, of course, major issues with how government Student Loans are calculated, based on assumptions of parental contributions – but we'd argue that becoming a guarantor for a high-interest loan is not necessarily a helpful solution.

It means family or friends could end up forking out much more when giving financial support to students than they would with zero-interest personal contributions.

It's no wonder, then, that many were outraged to see UCAS sharing promotional information about Future Finance to students. But what did the email actually say?

Email from UCAS Media about Future Finance

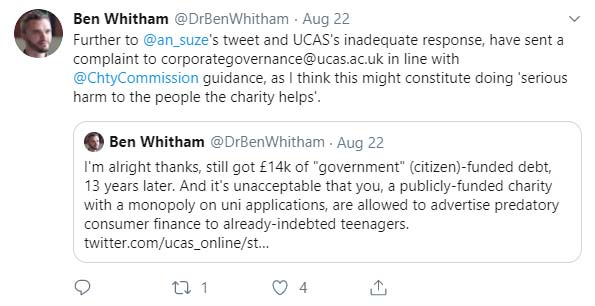

We've been sent a copy of UCAS's email about Future Finance.

Near the top of the page, a question mirrors the subject line, reading in block capitals, "STUDENT FINANCE NOT ENOUGH?"

The email continues to claim that "Future Finance is helping you get where you want to be".

A screenshot of the email was shared on Twitter by Suze (@an_suze) on 22nd August. The tweet's since had over 280 retweets and 800 likes.

Following this, a petition was set up on change.org with the title, "UCAS: Pledge to stop advertising for-profit loans to financially-stricken students".

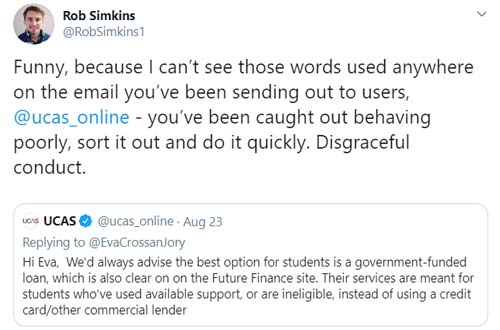

President of NUS Wales, Rob Simkins, described UCAS's actions as "disgraceful conduct" in a tweet on 23rd August, urging them to "sort it out and do it quickly".

NUS's Vice President (Welfare), Eva Crossan Jory, also tweeted her disappointment.

And, Dr Ben Whitham, a senior lecturer at De Montfort University, shared his frustration with a tweet highlighting Future Finance's shocking interest rates.

We spoke to Steph Hayle, the Community and Wellbeing Officer at University of York's SU. She told us:

It is extremely concerning to see a charity such as UCAS advertising alternative loan providers designed to take advantage of students.

Steph went on to warn students of the risks behind loans that, at first glance, can look like good deals.

Students must be wary of interest rates, hidden clauses, and pay back dates. Whist private loan companies may advertise deals at great rates the costs of these quickly rocket up. Don't be lured in by supposed 'deals' – check the terms and conditions to be clear about how much you'll really be paying back, and when you'll be expected to pay it.

Instead of advertising these unprotected and targeted loans, UCAS should use its position as a leading HE charity to work alongside Student Unions and the NUS to lobby for a more affordable cost of living for students, and a more appropriate financing model from the Government. Students' wellbeing should be a priority.

Andy Harmon, the Wellbeing Officer at Manchester Metropolitan University also disagreed with UCAS Media's email, telling us:

We would like to see UCAS be more accountable and transparent, and respect the trust that applicants have in their service.

We would also ask universities to be aware of these financial products, provide objective advice to its students and financially support students in desperate need.

And, at Save the Student, we were equally concerned by the news.

In response to UCAS Media's email, our resident money expert, Jake Butler, said:

I am shocked and appalled that UCAS have emailed 1,000s of students promoting high-interest commercial loans – especially with absolutely no mention of the alternatives.

Any company in a position of trust should not be abusing it by partnering or working with a commercial loan company. I would hope that UCAS, and other organisations, can learn from this – and at Save the Student we'll do our best to ensure that this doesn't happen again.

Whilst I have to admit that a very small number of students feel they need Future Finance to get through uni, I take real issue with the way in which they market to those in vulnerable positions as well as using trusted organisations to legitimise their loans as a way to boost your bank balance.

As a final point, the fact that a company with such extortionate interest rates can survive by offering loans to students shows that the government urgently needs to look into the size of the Maintenance Loans on offer to students.

UCAS defends the email about Future Finance

Credit: chrisdorney – Shutterstock

Discussing their marketing email about Future Finance, a spokesperson from UCAS told us:

UCAS Media regularly works with companies that provide products and services which we think will be useful for students, and they can opt-out of receiving these at any time.

We carefully consider who we work with and how we work with them, for example we will never partner with tobacco, alcohol or gambling companies.

It's frustrating to hear a generic response from UCAS which is strikingly similar to those they've given to members of the public on Twitter. But, it's also disappointing that they don't seem to consider high-interest loans aimed at low-income students to be comparable.

They continued:

UCAS always advises that the best option for students is a government-funded Student Loan. This is also made clear on the Future Finance website.

Unfortunately, this advice wasn't clear on the email about Future Finance's loan. In fact, the promotional info about Future Finance in the email worryingly includes the phrase, "The most trusted student lender" in a box with their Trustpilot score.

We were unhappy with UCAS's response so we replied, requesting they make amends for their arguably poor commercial judgement by:

- Sending email communication to all students on their database, signposting the other sources of financial support and advice available to students in hardship

- Ceasing their partnership with Future Finance with immediate effect.

In their reply, UCAS thanked us for our feedback, directed us to financial information on their website and informed us that students also receive emails from them about the Student Loans Company.

They then assured us that their customer framework (which decides who UCAS Media works with) is reviewed regularly.

We're not alone in being disappointed with UCAS's response to the controversy. Dr Ben Whitham said on Twitter that he has complained to [email protected].

Previous complaints about Future Finance's adverts

So far in 2019, a total of five complaints have been submitted to the Advertising Standards Authority (ASA) concerning the misleading nature of Future Finance's ads.

While they considered one case to not have grounds for an investigation under their rules, the other four were forwarded to the Financial Conduct Authority (FCA) as they fell outside of the ASA's remit.

A spokesperson from the ASA told us:

Complainants objected that there was no indication in the ad (poster) of the interest rate for those looking to take out the loans.

Also, they considered that the bold text of ‘student loan’ could imply that these loans are official student loans provided by the government with no financial risk for the lendee, rather than loans for students which if they do not pay back will be pursued and recovered through legal action.

In the marketing email from UCAS Media, there is no reference to Future Finance's interest rates. And, there's a sentence in bold which reads, "Wherever you're heading, our flexible Student Loans can help you get there."

It's interesting that there have already been several complaints to the ASA about similar aspects of Future Finance's ads this year.

UPDATE: UCAS promote Future Finance again (22/01/20)

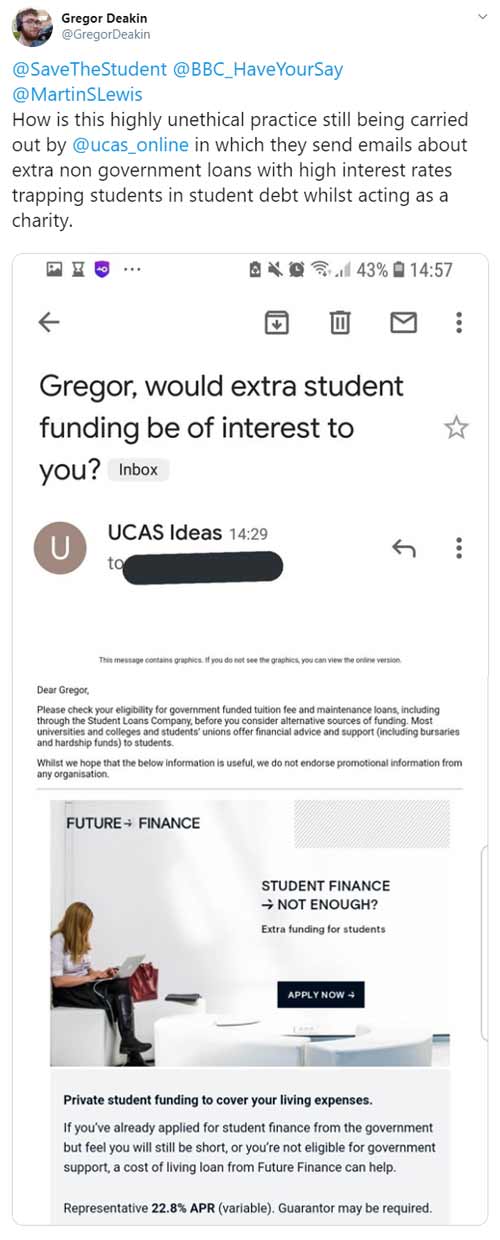

On the 22nd January 2020, we were tweeted by a student from Liverpool Hope University. Five months on from the backlash that UCAS received for the first batch of emails, they once again contacted students with an advert for Future Finance.

Unlike the previous email, this one started with a disclaimer encouraging students to apply for a Maintenance Loan and seek financial advice from their universities before applying for a commercial loan. This was one of the big issues we raised following the first email – as was the lack of info on the (frankly extortionate) interest rates, which this time around is clearer.

But, while UCAS and Future Finance have clearly noted our concerns, they have not gone far enough. For UCAS, an organisation that is trusted by students across the UK, to promote risky, high-interest loans to its users is nothing short of irresponsible.

With that in mind, upon finding out that UCAS had sent out another email promoting these loans, we took to Twitter and called for them not to send out such emails again. You can read our thread here.

UPDATE: UCAS 'pause' promotion of Future Finance (07/02/20)

Credit: Atanas Bezov - Shutterstock

Big update! On 7th Febraury 2020, UCAS announced on their website that they are now pausing their promotions of private loan companies.

UCAS's statement said that, in response to feedback:

We decided to pause our activity with private loans companies, and no further activity is currently planned.

It is clear that they have listened to concerns raised by students, academics, Save the Student and others:

UCAS takes its responsibility to provide neutral and trusted information very seriously. A key role we play for students is providing them with information and advice on financial support and choices, such as opening their first student bank account.

It is clear funding options are continuing to evolve and the cost of living while at university is a key consideration for students. It is our responsibility to help students understand and navigate all their choices.

As this is a developing market, we listen to feedback from students and valued colleagues across the education and financial sectors [...] to ensure we provide students with appropriate choices, including those that are commercially available.

We hope that, with this 'pause', UCAS will not continue to promote similar companies again in future.

Alternative options to taking out a commercial loan

Credit: Watchara Ritjan – Shutterstock

Around 3% of students get their money from a commercial or payday loan, but we hope to see that percentage going down as students learn more about what they can do if their Maintenance Loan doesn't stretch far enough.

If you're struggling with money at uni, check out our guide to coping with a cash crisis. There are a number of options open to you so you can avoid taking out a commercial loan, like talking to your uni, finding student bursaries and seeing a student money advisor.

We'd also suggest having a look for a part-time job and learning how to budget at university.

Find out more about Future Finance loans and the alternatives in our guide.