Student Banking Survey 2017: Results

UPDATE: View our 2022 Student Banking Survey.

Picking the right student bank account can make a big difference to your cash flow. But which banks do students rate, and why? We reveal the rankings that count.

Following on from our popular National Student Money Survey, we decided to turn our attention to student bank accounts and more specifically how students rate their services.

Following on from our popular National Student Money Survey, we decided to turn our attention to student bank accounts and more specifically how students rate their services.

More than 1,000 of you answered our Student Banking Survey 2017 to tell us what you think of your bank, why you chose them and how overdrawn you really are - cheers!

Check out our quick fire roundup of the report in all its glory below.

What’s on this page?

Choosing the right bank account

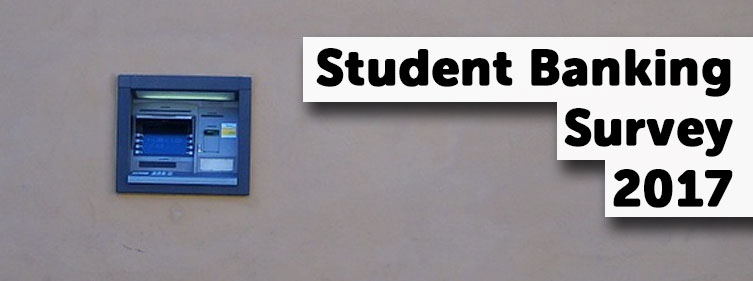

Why do students choose their accounts?

Ever since we wrote our famous student bank account guide we've tried to delve down into why students really choose the bank they're with.

Perhaps alarmingly, the majority of students (44%) pick an account with the bank they're already with. Why is that worrying? Well, because 1000s of you are potentially missing out on a better deal because of loyalty. Or laziness. It's vital to remember that banks aren't loyal to you, so why should you be to them?

One positive is that this number has dropped from last year's 48% so perhaps we're getting through to you 😉

We also found an almost even split between choosing an account for its 0% overdraft (which lets you borrow emergency cash for free) and because friends and family banked there. And, contrary to the perception that students are always glued to their gadgets, almost 1 in 5 say they pick your bank because of physical location.

Perhaps it's no surprise that close to a third of students are swayed by freebies. Especially with what's on offer this year.

36% of you also told us you don’t have a student account at all, preferring to rely on bog-standard banking instead. The main reason for this is that some current accounts offer much better in credit interest if you're never in need of that juicy overdraft.

Are students savvy about switching?

Switching accounts is not difficult. Due to government legislation the banks will now transfer over any direct debits automatically as well as handle the switch with each other, so the effort for you is next to none!

Despite this only 16% of you are looking to long off your current bank and move to a new one. Perhaps this might be because you already have the best bank for your needs but we had hoped to see the number a little higher this year (in fact it's 2% lower than 2016).

Student comments:

- I was able to switch to a student current account entirely online.

- Never been with another bank, does what it needs to do. However could have switched for better stuff

- My bank is reliable, free railcard, branch on campus

- I decided to switch banks when I saw that I could get a bigger overdraft and better freebies elsewhere.

How satisfied are students with their bank?

So this is the info you're really after. How does your bank rank in comparison to the rest of the bunch?

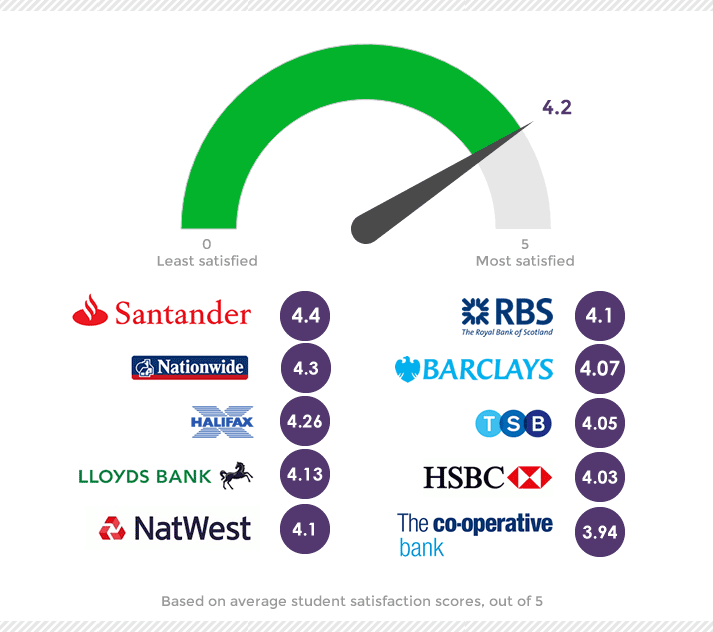

In somewhat of a shock result it turns out that students look kindly on their current bank with the average score across the board being 4.2 out of 5.

Santander are top of the pile again since taking the top spot in 2016. Nationwide and Halifax also retained positions 2 and 3 respectively. HSBC were this year's biggest movers, dropping from 4th to 9th.

Not happy with your bank? Our tips on complaining the right way can help you sort it.

Which banks are most popular with students?

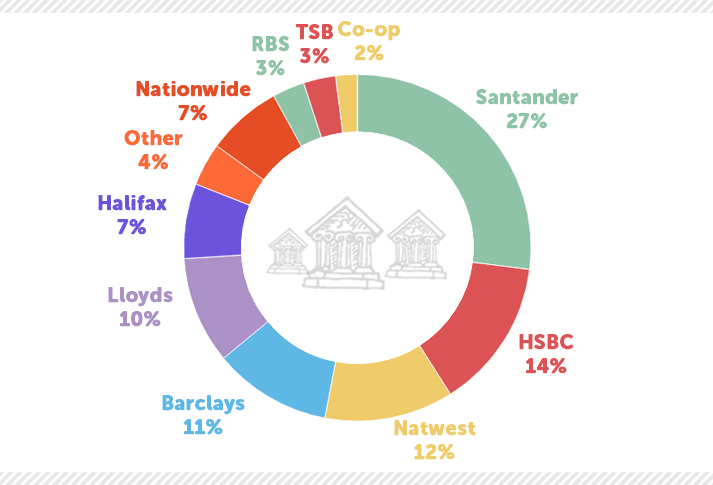

It's not much of a surprise that Santander is the most popular (seeing as it's the best rated).

Nationwide have increased their student account users by 2% on our results last year with many of the other accounts keeping a similar share of the market.

Student comments:

- If I have ever had any problems or enquiries they were always easy to talk to and very accessible.

- I was given a free railcard. They refunded one month of overdraft fee payments when I was in America and wasn't able to check my account.

- They have a slow banking app, which isn't great and they had no additional extras.

- I signed up for a freebie and nobody at the bank seemed to know about it. Still chasing it up now.

- The amount of fees they have taken from me over the last year have been awful. I have been getting charged approximately £50 a month for a year.

Student borrowing

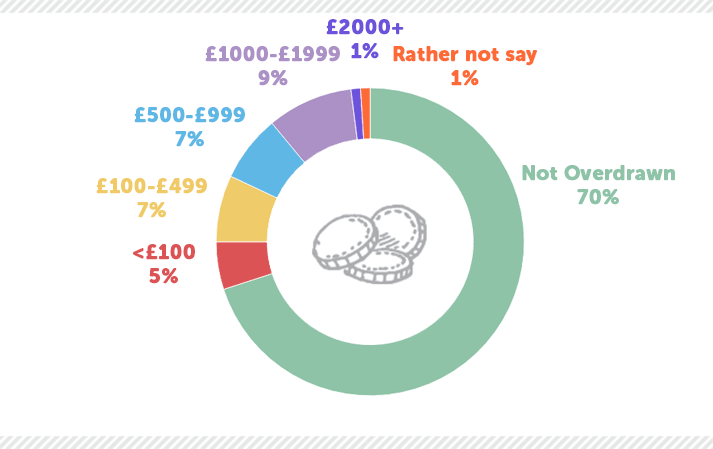

Bet you didn't expect to see that such a huge proportion of students are not overdrawn. Especially with 78% saying they struggle with money.

Overdrafts are pretty much ingrained into student life which is why we have an all singing all dancing guide to student overdrafts.

Student comments:

- I wouldn't be able to get by without [an overdraft]. It is completely essential.

- They're very picky about overdraft increases and I have gone through the application process at least ten times

- The overdraft has pretty much saved me

What do you think of your bank? Let us know in the comments.

Need extra info? You'll find everything you need to know about managing your money at university in our free money cheatsheet.

About the Student Banking Survey 2017

- Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line.

- You’re welcome to reference or re-use data from the survey with credit and a link back to this page: "Source: The Best Student Banks Survey 2017 / www.savethestudent.org"

- Survey polled 1,101 current or recent students in the UK between 3rd-14rd August 2017

- Background reading: National Student Money Survey 2017

![What do students spend money on? [stats]](png/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](png/what_students_spend_money_on2-100x100.png)