Student Banking Survey 2020 – Results

UPDATE: View our 2022 Student Banking Survey.

Each year, the Student Banking Survey offers a fascinating insight into what students really think about their banks – and this year, there have been some pretty interesting findings.

Credit: fratello – Shutterstock

Now in its sixth year, the results from our annual Student Banking Survey 2020 are here, reflecting the ever-changing views and banking habits of students in the UK.

With responses from 1,752 prospective, current and recent university students, the survey reveals how young people choose their student bank account, use their overdraft, spend cash and much more.

Here's what we found...

What's in our report?

Key findings from the Student Banking Survey 2020

Here's an overview of the key findings from this year's banking survey:

- Over two in five students chose their current bank because they'd already banked there before uni.

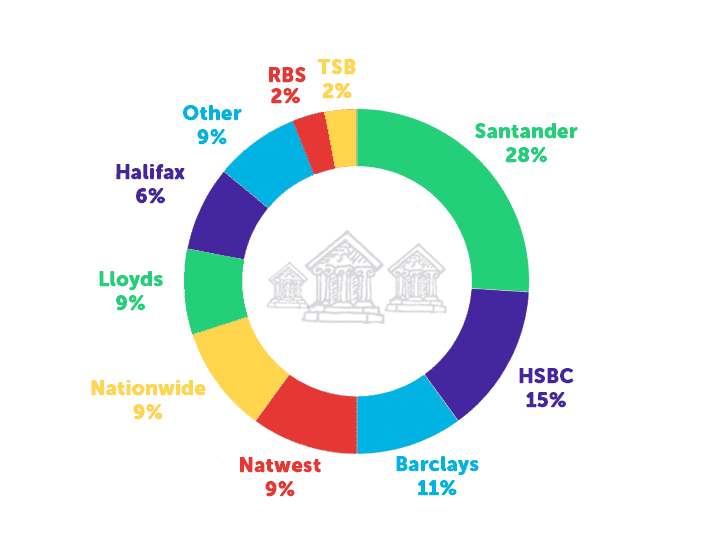

- The most commonly used bank by students is Santander – as many as 28% bank with them.

- The percentage of students who never use cash has trebled since last year.

- Among students who have an overdraft, over a quarter have hit their limit at some point.

- Only 13% of students have a Lifetime ISA (LISA).

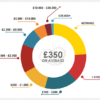

How do students choose a bank?

Perhaps the most surprising change in this year's banking survey is the proportion of students saying they'd chosen their bank based on the interest- and fee-free overdraft. This has dropped drastically, down from 33% in last year's banking survey to 15% this year.

This mirrors a change that we've seen in the results of our National Student Money Surveys. In 2019, 49% of students said they used an overdraft as a way to access money, but this dropped to 38% in 2020.

As interest- and fee-free overdrafts are generally presented as major selling points of student bank accounts, it's interesting to see fewer students viewing them as significant features when selecting and using their accounts.

See below for more information about how students use and manage their overdraft.

Where do students do bank account research?

| Type of research | How many used these methods |

|---|---|

| Online research | 85% |

| Parents | 34% |

| Friends | 29% |

| Bank | 16% |

| University or SU | 7% |

| School | 2% |

| Other | 2% |

The vast majority of respondents turned to the internet to find the best student bank account for them, with the next most popular choice – advice from parents – used by significantly less.

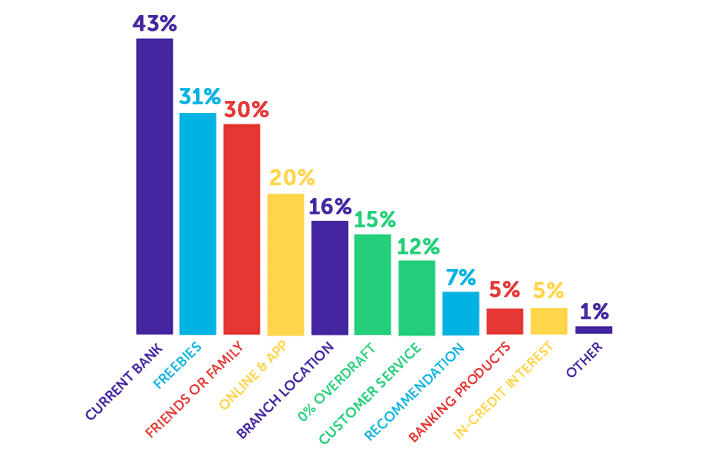

Do students consider switching banks?

To get the best deal on a bank account, it's definitely worth remaining open to the idea of switching banks. New customers are often offered the best deals and freebie incentives by banks, so staying loyal to a bank can mean you miss out.

However, despite this, only 13% of students say they are looking to switch accounts. This is down from 17% who had said the same last year.

Switching accounts is super easy, and can really pay off. Check out our full guide to switching current accounts for more info.

What is the most popular bank among students?

By far, the most commonly used bank among students in the survey is Santander, with over a quarter saying they hold an account with them.

In fact, Santander's popularity seems to be growing, with 2% more students saying they have an account with them in 2020 compared to 2019.

With competitive freebie incentives and a sizeable 0%-interest overdraft, we've placed Santander at the top of our list of the best student bank accounts.

Student satisfaction scores

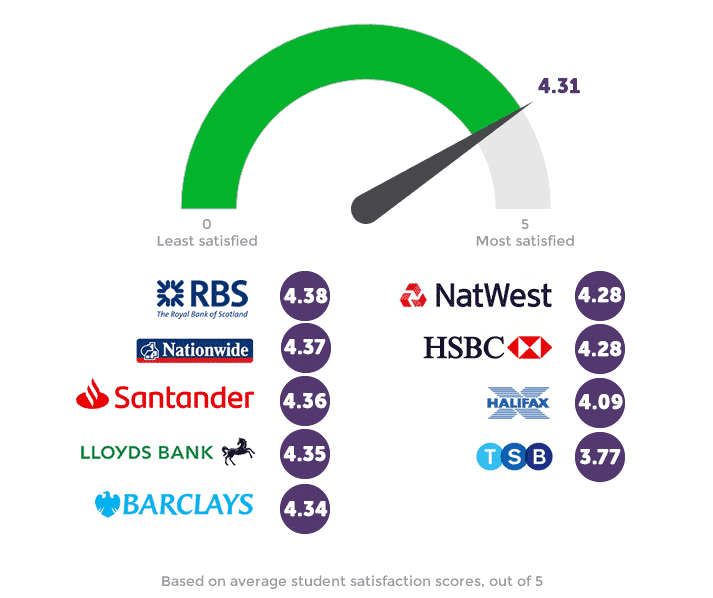

When we asked students to rate their banks, they were on the whole very positive – on average, students gave their bank a rating of 4.31 out of 5.

The only bank in the survey to be rated under 4 out of 5 was TSB, which got 3.77.

How often do students use cash?

Here's a breakdown of how often students say they're using cash in 2020, compared to 2019:

| How often students use cash | Student responses in 2019 | Student responses in 2020 |

|---|---|---|

| More than once a day | 9% | 3% |

| Once a day | 6% | 3% |

| A few times a week | 25% | 17% |

| Once a week | 17% | 11% |

| A few times a month | 30% | 36% |

| Less than once a month | 11% | 25% |

| Never | 2% | 6% |

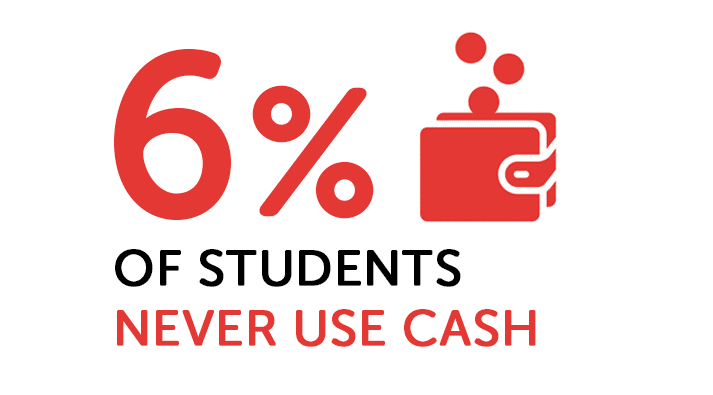

One of the most interesting findings to come from the Student Banking Survey 2020 is that fewer and fewer students are using cash.

Last year, 2% of students told us that they never used cash. But, this year, that figure has trebled to 6% of students saying the same.

What's more, among students that do sometimes use cash, they are generally doing so much less often. In fact, a quarter of students say they use cash less than once a month, while only 11% reported the same last year.

There are a number of reasons why students may be using less cash.

For starters, contactless payments are much more widely accessible than they have been in previous years, with most debit cards now contactless-enabled.

Plus, app-based banks and services like Google Pay and Apple Pay make it incredibly easy for people to make payments straight from their smartphones.

Cash is no longer quite as necessary as it once was. When we then consider how much more hygienic contactless payments are compared to cash and chip and pin payments, it's no wonder that this year, in particular, we've seen a significant change.

The coronavirus pandemic has changed a huge amount about day-to-day life – and this seems to include how students handle and spend money.

Student borrowing habits

As we mentioned earlier, we've seen a decrease in students thinking of interest- and fee-free overdrafts as a determining factor when looking for a student bank account, along with fewer students making use of the funds while they're at uni.

How overdrawn are students?

| Size of overdraft | Students overdrawn by this amount |

|---|---|

| Not overdrawn | 79% |

| £99 or less | 5% |

| £100 – £499 | 5% |

| £500 – £999 | 4% |

| £1,000 – £1,999 | 4% |

| £2,000+ | 1% |

Among all students in the survey, only one in five said they were in their overdraft – a noticeable change from the 2019 results where two in five had said the same.

Plus, only 5% said this year that they were over £1,000 overdrawn, compared to 11% last year.

The drops in these statistics could suggest students are generally using overdrafts less. Yet, when we looked specifically at the experiences of students who are in their overdraft, there were some quite concerning findings...

Students in their overdraft

For a lot of students who use an overdraft, it can be really helpful as an emergency source of cash if they run out of money before their next loan instalment.

Most student bank accounts offer overdrafts without added interest or fees – these, when used carefully, should carry very little risk.

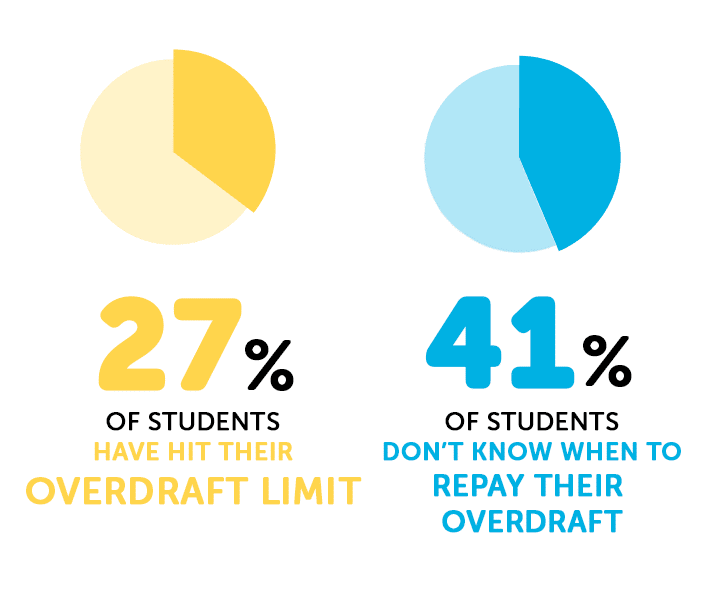

Worryingly, the banking survey has found that over a quarter of students who use an overdraft have hit their limit at some point. As well as this, two in five don't know when to repay their overdraft, suggesting the terms aren't clear enough to students when they first open the account.

Overdrafts are a form of borrowing, so it's essential that students are well informed about the best ways to use them, along with when and how to pay them back.

To help, we have a full guide on using and paying off a student overdraft.

How many students have Lifetime ISAs (LISAs)?

Lifetime ISAs (LISAs) are similar to the Help to Buy ISA, which stopped being available to new customers in 2019.

With LISAs, the government offers an annual bonus of 25%, up to £1,000, on top of what you save, making them hugely effective ways of saving money.

As the name suggests, LISAs are intended for lifetime investments, and can only be used if you're buying your first home, if you're over the age of 60, or if you are terminally ill, with less than 12 months to live.

Despite offering some of the best returns compared to other schemes and saving products, it's surprising how few young people are utilising them.

Our banking survey has found that 31% of students don't know what a LISA is, with only 13% having one.

And, of those that are familiar with LISAs, over half (56%) have not yet got one.

About the Student Banking Survey 2020

- Source: Student Banking Survey 2020 / www.savethestudent.org

- Survey polled 1,752 prospective, current and recent students in the UK between 26th August – 15th September 2020.

- Want to know more about the survey, or need case studies, comments or quotes? We're happy to help – just drop us a line.

![What do students spend money on? [stats]](png/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](png/what_students_spend_money_on2-100x100.png)