Student Banking Survey 2018: Results

UPDATE: View our 2022 Student Banking Survey.

A student bank account is the ultimate uni essential - but which ones cut the mustard? We reveal the banks that students love, loathe and are most loyal to.

Hot on the heels of the National Student Money Survey, our annual student banking survey unwraps the reality of managing money at university.

More than 2,000 of you spilled the beans about banking and borrowing: thank you! With more responses than ever before, it’s clear that all banks are not equal...

What’s on this page?

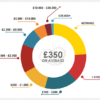

How do students choose a bank?

Whether it’s loyalty, laziness or fear of the unknown, students tend to stick with the familiar. Almost half of those we spoke to pick an account with their existing bank, while a third go with one friends or family use. Don’t kid yourself: loyalty doesn’t pay!

Perhaps most surprisingly, 1 in 5 students pick their bank by location. This, along with little interest in digital app-based banking, suggests lots of you prefer to get cash (or advice) in person.

Banking features aren’t just window dressing. If you accidentally overspend (or need emergency cash), a 0% overdraft keeps costs to a minimum.

If you struggle to stick to a budget, banking online or by app can help, while decent customer service makes a big difference if you’re ever in a financial pickle.

Whatever you need your account to do for you, find your most important features in the graph above then choose a student account that delivers the goods.

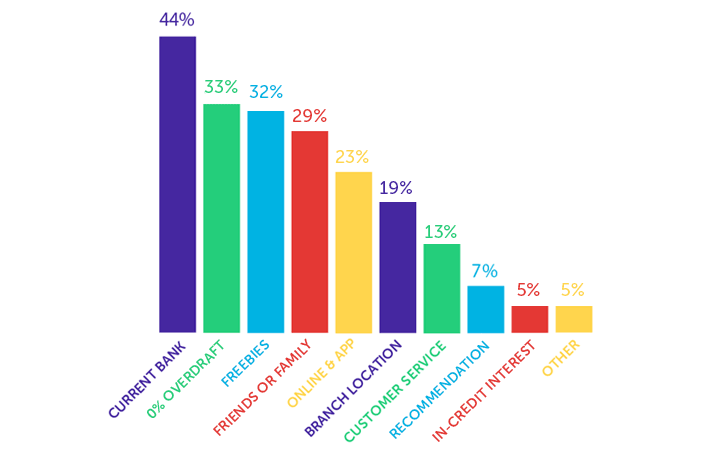

Are students savvy about switching?

Just 1 in 6 students are thinking about moving to a potentially better bank account (no change there since 2017). Hopefully, that’s because the bank you’re with can’t be beaten. If not, switching is possible with student accounts and isn’t as daunting as many think!

Almost all UK banking accounts use the Current Account Switch Service, which means direct debits, deposits and payments get moved to your new account automatically. In fact, there’s very little you’ll need to do yourself - and if anything goes wrong, the bank will fix it (and take care of any resulting charges or loss of interest).

You can even switch while overdrawn - so if you find a better deal with another provider, get on the case!

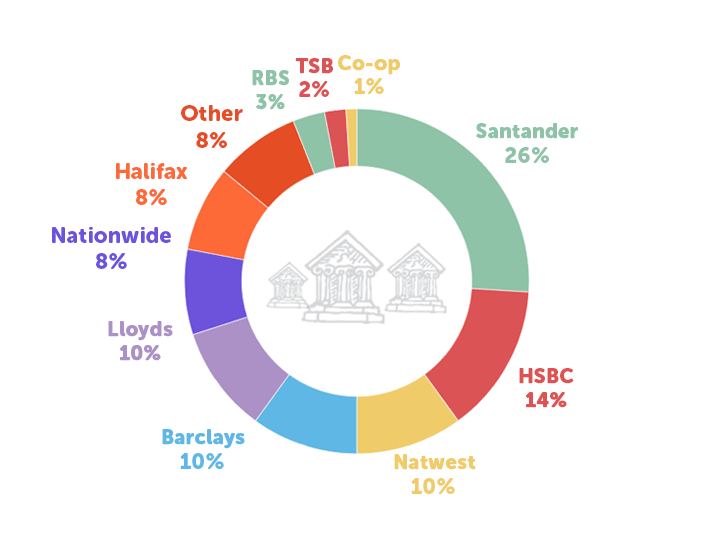

Which banks are most popular with students?

If you've plumped for a student account, chances are it's with Santander: almost 1 in 3 of you say you bank with them. They have also been our top pick account for the past two years.

Bringing up the rear are the Co-operative Bank and TSB, who both perform poorly for student satisfaction.

The future may be digital, but online banks haven't yet appealed to students: 84% say they don’t use app-based banks such as Monzo and Starling - yet with auto-savings, budgeting tools and prepaid cards making cash management effortless, you may be missing a trick!

It’s especially worth comparing online and high street banks if you’re not eligible for, or not interested in, a ‘student’ account, as you could be short changing yourself otherwise.

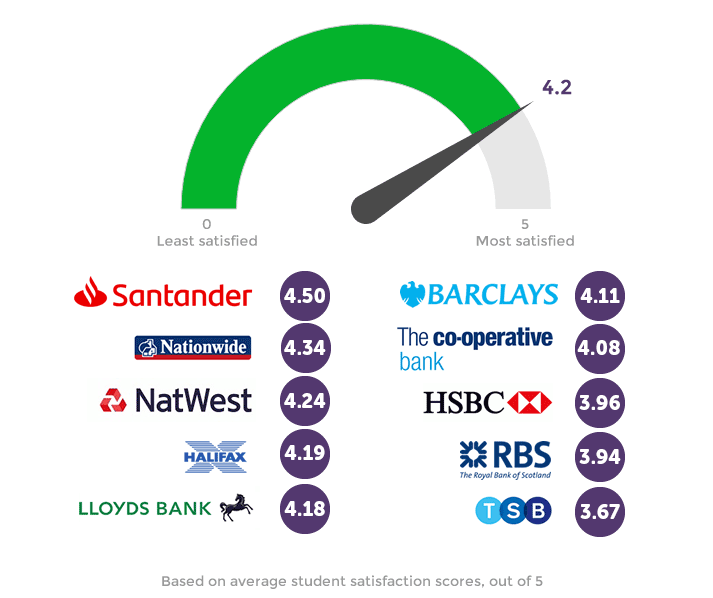

How satisfied are students with their bank?

At odds with the swathes of negative media towards British banks in recent years, students actually rate their banks relatively highly. Perhaps those freebies and overdrafts are doing the trick...

Santander remains a firm student favourite: they’ve not only improved this year but held the top spot ever since we started running this survey back in 2015.

Nationwide hold on to 2nd place, while NatWest jumps ahead of Halifax into 3rd.

With all the issues TSB have had this year, it's not a huge surprise they've dropped to last position for student satisfaction.

Student borrowing

The good news is that 67% of you say you’re not overdrawn. It’s worth noting here that only 64% of you use a student bank account - so the lack of free overdraft may be a major deterrent!

However, the longer you stay at uni, the more likely you are to borrow. In fact, of those overdrawn by £1,000-£1,999, a quarter are 2nd and 3rd-year students. This could be because despite lots of you starting your course with savings to hand, the money doesn’t last.

How overdrawn are students?

| Overdrawn by | Total | 1st Year | 2nd Year | 3rd Year | 4th+ Year | Postgrad |

|---|---|---|---|---|---|---|

| Less than £100 | 6% | 6% | 4% | 6% | 8% | 5% |

| £100-499 | 9% | 8% | 8% | 10% | 4% | 12% |

| £500-999 | 5% | 2% | 5% | 7% | 5% | 3% |

| £1,000-1,999 | 11% | 6% | 11% | 13% | 15% | 11% |

| £2,000+ | 1% | 1% | 1% | 1% | 1% | 2% |

| Not overdrawn | 67% | 76% | 69% | 60% | 65% | 63% |

| Rather not say | 2% | 2% | 2% | 3% | 2% | 3% |

If there’s any chance you’ll run short of cash during your course, agree an overdraft in advance. Think of it as a safety net against painful charges and the stress of refused payments: this guide to overdrafts explains all.

Reckon you’ll never need an overdraft? You could withdraw the cash and use it to earn interest on savings instead (only do this if you’re disciplined as heck, though).

Whatever you want the money for, you’ll need to understand how credit scoring works to get the best deals and – unlike 35% of students we spoke to – know that overdrafts have to be paid back after graduating!

13% of students claim to have some credit card debt. Credit cards aren't always bad so long as you pay off the balance in full before the interest payments mount up.

Want to name, shame or praise your bank? Leave us a comment below!

If you need help making sense of banking, budgeting, or money problems, start with our useful student resources.

About the Student Banking Survey 2018

- Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line

- You’re welcome to reference or re-use data from the survey with credit and a link back to this page: "Source: Student Banking Survey 2018 / www.savethestudent.org"

- Survey polled 2,177 current or recent students in the UK between 25th July - 6th August 2018

![What do students spend money on? [stats]](png/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](png/what_students_spend_money_on2-100x100.png)