Mental health suffers as students struggle with money

Our National Student Money Survey 2017 reveals more students than ever are stressed about money – and it’s putting them at risk.

If you struggle to pay your way through university, you could have a 50/50 chance of experiencing mental health issues such as depression, anxiety and feelings of hopelessness.

The worrying findings were uncovered by our annual investigation into what student life is really like across the UK. This year’s survey interviewed more than 2,300 students, with half saying their mental health has been negatively affected because of cash concerns.

How are students affected?

While an increasing number of students (now 84%) worry about money, a significant number suffer debilitating levels of stress as a result. Many students report feeling isolated or hopeless – often staying in their rooms unless they’re attending classes or working to earn extra income.

Ruby found her second year at the University of Lincoln hard-going. She told Save the Student:

Other than when I was in lectures, I spent most of my time on my own in my room. I couldn't sleep, and whenever I did it was only for a couple of hours at a time. I just felt tired all the time. I would be constantly panicking about money.

Jenna, a 2nd-year student at the University of Loughborough, comments:

I would skip meals so I didn't have to spend any money. When things then got to my lowest and I lost all motivation to live I began spending excessively to try and make myself feel better. This didn't work and I ended up having multiple suicide attempts and taking anti-depressants.

As well as poor mental health, the survey paints a grim picture of everyday hardship: 61% of students can’t afford to eat. Almost half – 42% – say relationships with friends and family suffer, while a third report that a lack of money affects their grades or ability to study. Sadly, this can be a vicious circle – students who report mental health issues are more likely to have relationship problems or disrupted studies, which in turn causes further stress.

Gemma, a student in the East Midlands says:

When I was stressed about money I found it really difficult to focus on my studies and if I had to spend money unexpectedly it would bring me a lot of anxiety. I already felt like I was on the back foot because I couldn't work whilst at uni due to my health condition, and it sort of snowballed from that.

As so many struggle to get by, the survey also found that some students are turning to potentially risky money makers, including gambling, drug trials and adult work.

Why are so many students struggling?

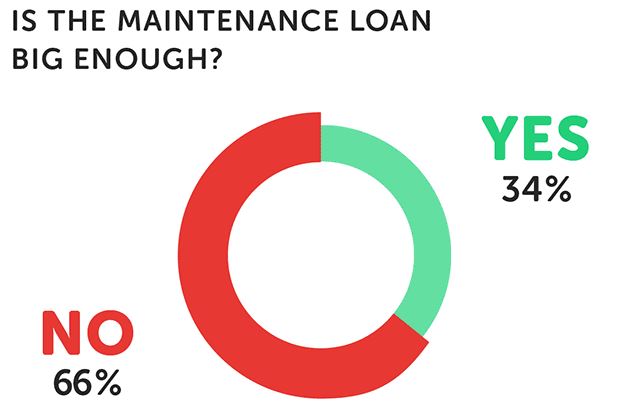

While lots of factors can affect mental health, when it comes to the cause of money concerns the Maintenance Loan is a big one. Two thirds of students who receive support say it’s just not enough to live on. And, while some students can ask their parents to cover the difference, loads of you feel incredibly guilty about asking – not a good position to be in!

Students say:

- I receive the minimum because my dad has a high salary but his mortgage and bills are enormous – he can't make up the difference so I have to work in several jobs around my degree and sell everything I can including myself

- Money is a massive worry for me. I don't have the option to ask parents for money... my maintenance loan/grant don't actually cover my rent. How am I supposed to live through university without enough money to cover rent?

- It’s really tough to keep thinking about money when it has an impact on your mental health – you end up avoiding thinking about it because you know you can't do anything about it, but then that just makes it worse because you don't keep tabs on what you're spending. It's a vicious cycle

- Being a student has been one of the most stressful, difficult times of my life. I think people should reconsider before they commit to it.

Shockingly, just a third of those who asked their university for help with finances said it was easy to get the support they needed.

Another major issue is the lack of knowledge about how much it really costs to get by. A massive 83% of students say they didn’t know enough about money management before starting university. If that’s you, don’t wait to find out – our ultimate guide to uni costs (and how to pay them) can help!

What can you do to protect yourself?

- If you’re struggling to manage your money or mental health, there are lots of places to get help. Need to talk right now? The Samaritans are available 24/7: phone 116 123 from the UK

- While stressing about long-term debt is understandable, make sure you’re not worrying unnecessarily. Finding out how the Student Loan works – and why it’s a better deal for students – could reassure you

- It’s also worth finding out what other cash is on offer, from student grants, to charity cash and corporate sponsorship. There are also plenty of ways to work for yourself – something that can reduce the pressures of unsocial shifts of zero hours.

You can see all the findings from the National Student Money Survey 2017 here. Where we quote students, we’ve changed their names to give 'em some privacy.