PETITION: increase Student Loans in England to catch up with inflation

Student Loans have fallen massively behind inflation, leaving many unable to even cover the cost of food. Sign our petition to increase funding and save students.

Credit: Michaelpuche (background) – Shutterstock

We can all agree that students should have enough money to keep a roof over their heads and put food on the table. But, for far too many students, this is no longer possible.

Over the past few years, Maintenance Loans in England have fallen well behind inflation. As a result, the loan – which was never really enough to live on in the first place – is now worth up to £1,500 less* than before the cost of living crisis. In effect, the Student Loan has been cut.

And the situation we find ourselves in isn't just bad luck. In Northern Ireland, Scotland and Wales, their governments saw how students were struggling with the cost of living crisis and boosted loans by between 9.4% – 40% in 2023/24.

But in England, the government chose to increase Maintenance Loans by just 2.8% – despite knowing that this would amount to a huge cut in the value* of the funding.

The impact of this has been absolutely devastating, with students from all backgrounds now worse off. Our most recent survey found that 18% of students had used a food bank in 2022/23 (almost double the amount from the previous year), while a shocking 64% told us they skip meals at least some of the time.

The financial struggle that students are faced with is getting worse, and this government cannot simply stand by and allow young people to go without food or contemplate dropping out of university.

That's why we've relaunched our petition, calling on the government to increase Maintenance Loans in England to catch up with inflation.

Please sign and share, as together we can #FixStudentLoans and secure the increase in funding that is so desperately needed.

* This is in 'real terms' – in other words, the 'real' value of something once you factor in the increased cost of other goods and services due to inflation. We'll explain this more below.

Think you might have signed this petition before?

We ran a similar petition earlier in 2023, calling for the government to increase Maintenance Loan rates in the 2023/24 academic year. That campaign closed in July and, while it was referenced in a government debate, it unfortunately didn't result in the change we hoped for.

If you signed that version of the petition, thanks for your support. But we need you to sign again as this is a new campaign. We firmly believe that with enough signatures, we can force this government into increasing the loan to catch up with inflation – so please sign and share!

More information about this petition

What's happened to Maintenance Loans in England?

As you'll probably know, the rate of inflation (the increase in the cost of goods and services) has been very high over the past couple of years.

In fact, between September 2021 – September 2023, inflation (RPIX) was 21%. This means that, on average, things cost about 21% more than they did two years ago.

It also means that money is worth less than it was back then. For example, if a loaf of bread cost £1 in September 2021, you could have bought 10 loaves for £10. But if the price increases by 21% to £1.21, you can only buy eight loaves with your £10.

So, unless your Maintenance Loan also increases at the rate of inflation, it will cover the cost of fewer things – in other words, its value falls in real terms.

How does inflation affect Maintenance Loans?

Over the past two years, the rate of inflation has been much higher than predicted.

This is an issue for students, as Maintenance Loan rates are always decided in advance based on projections of what inflation will be in the next academic year.

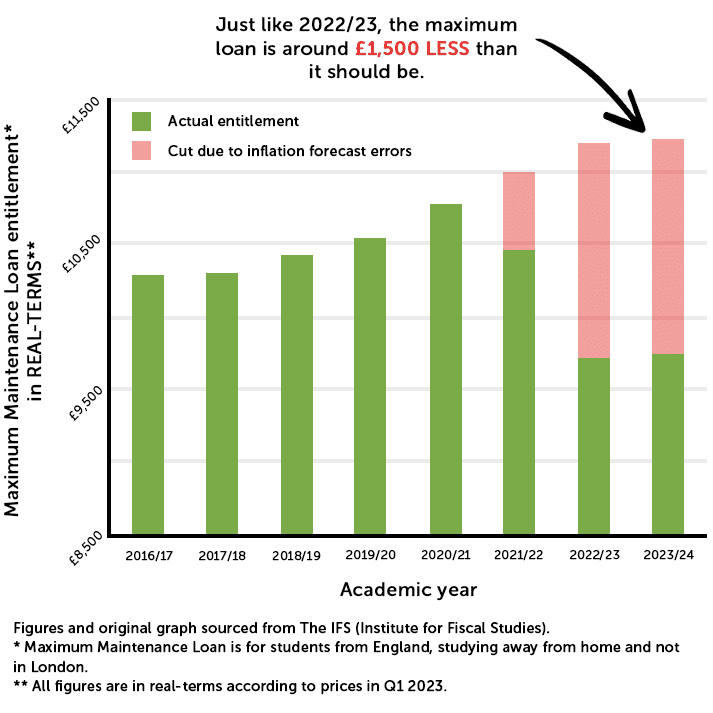

But as inflation has exceeded predictions (and by a huge margin, too), the value of your Maintenance Loan has been cut in real terms.

When they were setting the 2023/24 Maintenance Loan rates, this government should have increased the value beyond the projected rate of inflation to account for the errors made in the previous two years. But instead, they simply increased it at the projected rate (2.8%).

Will Maintenance Loans keep up with inflation?

According to our 2023 National Student Money Survey, this real-terms cut means that, on average, Maintenance Loans now fall short of living costs by a huge £582 every month. This shortfall has more than doubled since 2020, and the loan now covers less than half of the average cost of living.

As the graph below shows, the maximum Maintenance Loan on offer this year is around £1,500 less than if it had kept up with inflation.

During a cost of living crisis, this is utterly unacceptable and a devastating blow to students.

Worse still, as Maintenance Loans increase as a percentage on top of the previous year's amount, these errors will become a permanent feature of the system – even once inflation returns to more normal levels.

Unless this government corrects the mistakes of previous years and ensures Maintenance Loans catch up with inflation, students will continue to be significantly worse off every single year.

Why are we only demanding change in England?

In 2023/24, only the English government set Maintenance Loan rates that left students significantly worse off than in previous years.

In Northern Ireland, maintenance funding increased by 40%. This was a huge rise, but it's worth noting that the value of the loans had been frozen since 2010, so it was long overdue.

In Scotland, each band of maintenance funding increased by £900 on the 2022/23 levels. This represented an increase of between 11% – 17%.

Meanwhile, in Wales, where the value of maintenance support is tied to the National Living Wage, funding increased by 9.4% in 2023/24.

Why should you sign this petition?

Credit: gdsteam - Flickr

Still unsure if you should sign the petition? Here are just a few of the reasons to help us #FixStudentLoans:

- Universal Credit and pension payments have risen with inflation – There was public outcry at the idea that these might not increase at the rate of inflation. As a result, the government committed to increasing both in line with inflation in 2023. As the equivalent form of support for students, it's only fair that Maintenance Loans keep up with inflation too.

- Students have had almost no cost of living support – With the exception of the £400 energy grant, most students couldn't claim support from any of the government's extra cost of living support funds, despite being among the lowest-income groups in the country. In fact, even the energy grant was inaccessible to many, including all students living in halls.

- Parents can't afford to subsidise their children – Reducing the value of the loan in real terms means more students will rely on their families for help, and to a greater degree than ever before. But parents are being squeezed by the cost of living crisis too, and many can't afford to sacrifice £100s more every month to help their children.

- Universities are less able to help – The government has frozen tuition fees in England yet again, meaning universities have also seen a real-terms cut to their income from UK students. The government has repeatedly passed the responsibility of helping students onto unis, but many are now facing financial struggles of their own and unable to do so.

What else can you do to help?

Signing our petition is super helpful, and sharing it with your friends and family (and anyone else, really!) is better still.

We'd also encourage you to write to your MP, asking them to put pressure on the government to review this decision and increase Maintenance Loans to catch up with inflation.

We've published a template letter to MPs for you to use, which includes instructions on how to find their contact details.

Finally, please encourage your SU to back this campaign if they haven't done so already. The Maintenance Loan rates affect all students from England, and everyone will suffer if the government doesn't bridge the shortfall that's emerged over the past few years.