Students unexpectedly have their postgrad loans revoked in SLC cock-up

The SLC admits 68 master's students have had their loans withdrawn after being initially accepted due to ‘human error’ and aren’t actually eligible after all.

The Student Loans Company has just revoked loans for 68 postgrad students in the UK, admitting they weren’t actually eligible for the loan in the first place.

The Student Loans Company has just revoked loans for 68 postgrad students in the UK, admitting they weren’t actually eligible for the loan in the first place.

The SLC say that students were initially accepted as a result of human error, and that some members of staff misinterpreted the regulations when processing applications for the government's new Postgraduate Loans.

This is the first year that the government has started offering loans to students looking to do a master's at a UK university, but the complicated criteria has meant a large proportion of UK students aren't eligible.

This news comes just weeks after it was revealed the SLC have had to refund 300,000 UK graduates due to overcharging millions of pounds in student loan repayments. However, plans to completely digitalise the whole loans system in order to avoid blunders like these were abandoned following a dispute a few months ago.

Terms of the loan

The new Postgraduate Loan consists of up to £10,000 to be used towards tuition fees, course costs or living costs - whichever is most useful to students.

The new Postgraduate Loan consists of up to £10,000 to be used towards tuition fees, course costs or living costs - whichever is most useful to students.

The loan is paid in three instalments over the course of the year for up to two years (but note that you'll still only ever get a max. of £10k in total, this is not per year).

Twenty of the 68 students who have just had their loans withdrawn had already received their first instalment, and will now have to either drop out of their course, ask for support from parents, or magically stump up thousands of pounds to cover both tuition fees and living costs from some other source.

From what we can gather, it seems that those who have already incorrectly received their first lump of PGL cash won’t have to repay it, at least!

Why the students were rejected

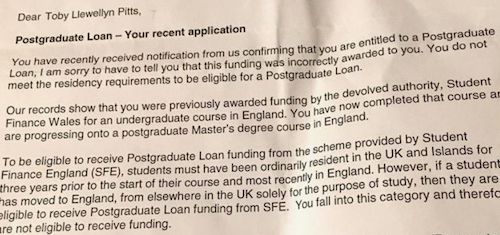

Credit: Toby Pitt/ BBC

Credit: Toby Pitt/ BBC

The affected students were told that following a review, it was decided that they don’t actually tick all the necessary boxes to be eligible for the loan, particularly in the region of residency requirements.

One section of the loan requirements states that you must be living in the UK for three years prior to application, so if you just spent a gap year living abroad, it’s likely you’d have to wait a few years before you’d be eligible for the £10k.

However, the part that caused all this complication was that the T&Cs state that you must also be living in England when you apply for the loan, and for reasons other than study. Bizarrely, this also applies to students wanting to do a master's in the UK but outside of England – in Scotland, Wales or Northern Ireland.

All students who have had their loans revoked by SLC were from Wales, but had been studying at English universities for their undergraduate courses, and were applying for the loan to continue their studies in England.

But as these students were living in England at the time of application because of study and not just living or working (which would make them classify as a 'normal' resident in England), this means they don't qualify for the loan.

In quotes...

Toby Pitts, 21, told the BBC he was "devastated" he's had his loan revoked, and is angry with how the SLC handled things. He said:

They've admitted they've made a mistake but there's no accountability at all which is really frustrating me. All the burden, all the pressure of their mistake, has been put on me as a student which is wrong really.

Kirsty William, Wales’ Education Secretary has said:

We have been in discussions with Student Finance England and the UK government urging them to provide help to those affected and make sure no-one suffers financially. As a result, the Student Loans Company has assured us that all available options will be used to compensate those who have suffered financial loss as a result of the error.

If you're thinking about applying for the PGL, or have already been accepted but aren't sure if you're 100% eligible, use this PGL checklist to make sure you tick all the right boxes – don't wait for the SLC to chase you up!

Have you been affected by the PGL application errors? Please get in touch with us!