£9k fees failure, Students Sexually Assaulted, Lloyds Islamic account…

£9k fees may not save taxpayers money

A "think tank" has warned that the new £9,000 tuition fees may not actually help save taxpayers money.

A "think tank" has warned that the new £9,000 tuition fees may not actually help save taxpayers money.

The main issue raised by the think tank was that the new fee system only saves around 5% in the long run due to the majority of students never having to pay back the full amount. And with the Conservatives unwilling to confirm that they won't raise fees again it's all looking a little shaky.

Our take: This is all slightly confusing but it's not really a surprise. We don't want to keep banging on about it but we could have told the government the new loans system was pants in 2011 when they revealed it. The most worrying thing is what the plans might be in order to cut the losses (eg. increased repayments).

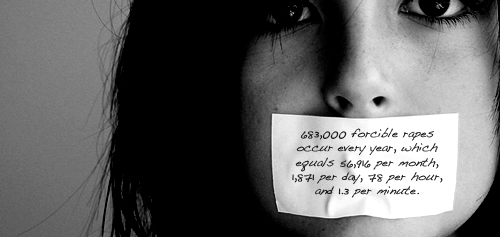

1 in 3 Cambridge students sexually assaulted

According to a report by the women's society at Cambridge University around 77% of students have experienced sexual harassment and almost 1 in 3 have been sexually assaulted.

According to a report by the women's society at Cambridge University around 77% of students have experienced sexual harassment and almost 1 in 3 have been sexually assaulted.

The main catalyst appears to be nights out which involve heavy drinking and dimly lit clubs.

Our take: These figures may be a little high but there's no denying the issue. Perhaps the most alarming thing though is the number of students that claim they have been ignored by uni staff when reporting incidents.

Samba mobile closes down

The SIM only broadband provider Samba mobile is closing down due to an unsustainable business model.

The SIM only broadband provider Samba mobile is closing down due to an unsustainable business model.

Samba offered users broadband SIMs for less than £6 and then allowed users to gain more data allowance by watching adverts.

Our take: Yet another mobile company casualty (similar to OVIVO mobile). It appears as if the company was simply priced out of the market by the big boys which is a real shame. If you were a customer it's unlikely you can get any refund either...

Lloyds bank drops overdraft fees for Islamic bank accounts

It has emerged this week that the £6 fee for going into an unplanned overdraft will be dropped for those with an Islamic bank account at Lloyds bank.

It has emerged this week that the £6 fee for going into an unplanned overdraft will be dropped for those with an Islamic bank account at Lloyds bank.

However, the bank have confirmed that anyone is available to apply for an Islamic account irrelevant of religion or background.

Our take: This story has been blown waaaaay out of proportion by certain sections on the media. It's a touchy subject but we just wanted to make a few facts clear... anyone can apply for an Islamic account, the account is not allowed a planned overdraft & unplanned overdrafts (where the £6 charge was used) are very rarely provided to holders of the account.

As with most accounts there are positives and negatives to it but it's definitely one to consider if you are shopping around. Just be aware that there are negatives such as no interest and no planned overdrafts.